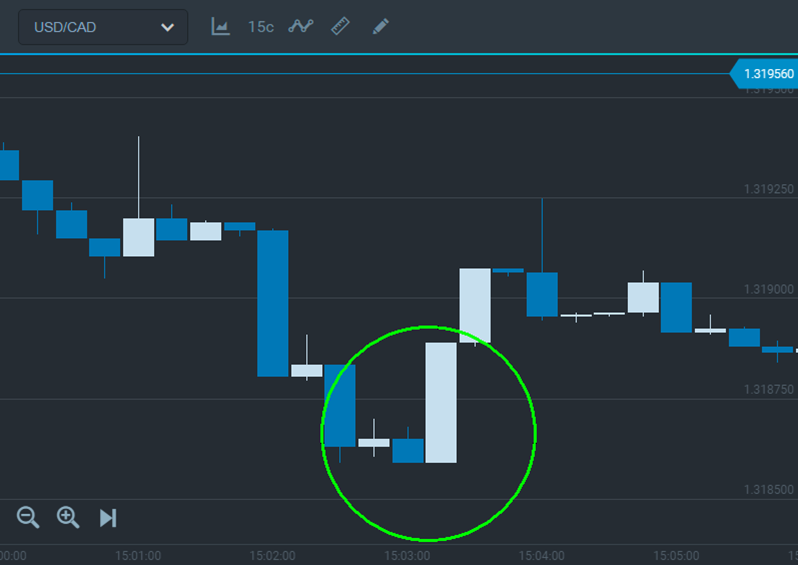

Tweezers Strategy

A potent reversal signal to watch out for is the tweezers pattern. It consists of two candlesticks with opposite directions and identical highs or lows. In a downtrend, tweezers candlesticks share the same lows, while in an uptrend, they have matching highs. These highs and lows of the tweezers can correspond to either the closing prices or the candlestick shadows. The formation of these candlesticks may occur consecutively or have other candlesticks in between. This robust signal can either reinforce or be reinforced by other candlestick formations.

What to do when you see this signal:

1) If you see the candlesticks with the same minimums or maximums on the chart be prepared for a reversal price movement.

2) After closing the candlestick having formed tweezers trade in the changed direction.

Buying a call after tweezers formation

Tweezers with bullish engulfing

The tweezers formation provides a strong signal, especially when it appears at support or resistance levels. While it's not essential to wait for confirmation, if uncertainty persists, you can opt to wait for the next candlestick and observe its direction. Confirming the signal is primarily beneficial for preserving your profits.